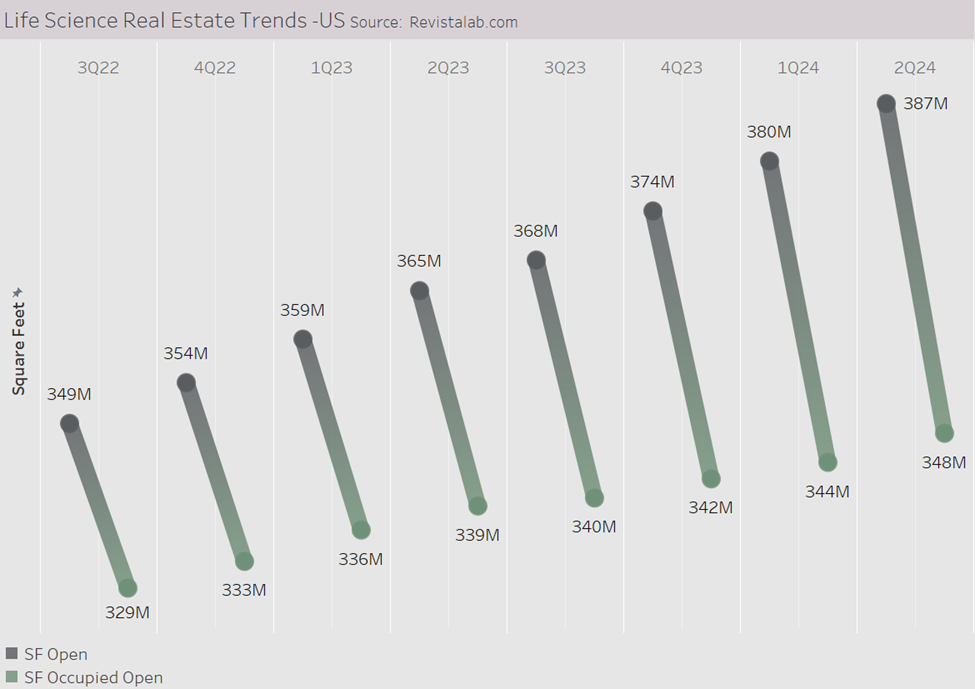

For those tracking the Life Science Real Estate Sector (LSRE) it should be no surprise that supply is growing currently. The construction run up resulting from pandemic era driven research activities has been morphing itself into completions over the past few years. This, in turn, has resulted in falling occupancy rates across the US. The occupancy rate for US based LSRE has fallen from 95.2% in 2Q22 to 89.5% as of 2Q24. To illustrate the supply/demand dynamic we can look at actual demand or occupied square feet (SF) each quarter compared to open actual supply in SF. In 3Q22 there was 329 million(M) SF of occupied space compared to 349M of SF open. As the next few quarters unfolded the amount of occupied SF began to grow but SF open grew faster. During the next 8 quarters and through 2Q24 occupied SF grew to 348M. This is a gain of 20M SF of occupied space over the past 2 years – not bad! But, supply, not to be outdone, has grown at a more impressive rate. SF open grew from 349M SF in 3Q22 to 387M SF in 2Q24, that is growth of 38 million square feet or roughly 11% from 3Q22.