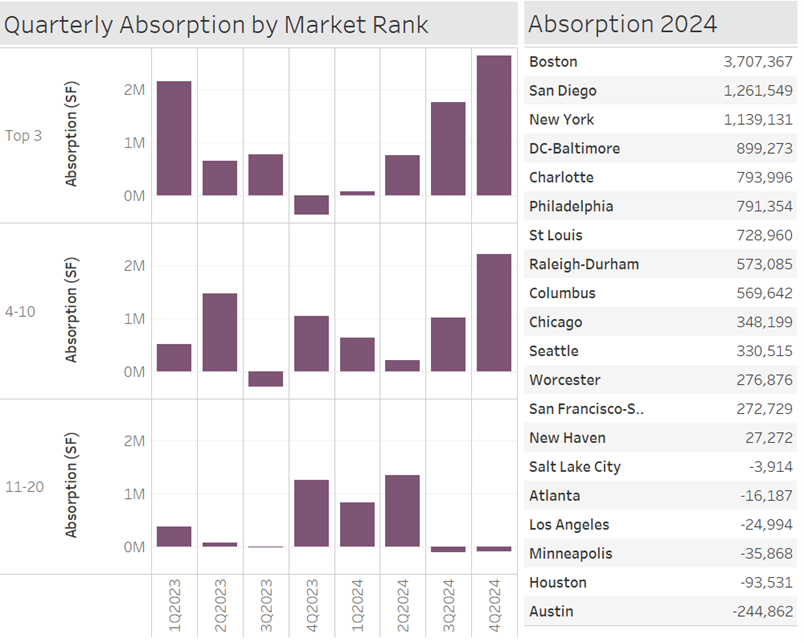

Despite declining occupancy in 2024, it was a largely positive year on the demand side. 70% of the top 20 markets had positive absorption in 2024. Boston gained about 3.7 million in occupied space throughout the year. San Diego and San Francisco gained 1.2 million and 272 thousand respectively. A lot of this absorption was due to the completion of pre-leased, long-term developments. The smaller markets (11-20) had strong absorption at the start of 2024, but dropped off to slightly negative in the back half. Texas markets struggled the most, with Houston and Austin having negative absorption during the year. St. Louis, a market that is not covered extensively, ranked 7th in absorption. This is due to the completion of an over 600,000 sf neuroscience building built by Washington University. In a similar vein, Columbus, Ohio climbed the ladder as the result of the completion of 2 large owner-occupied facilities. Demand for space clearly grew in 2024, but how will potential budget cuts to research funding affect the industry going forward? Make sure to stay tuned, as our 1Q25 data will be published in a couple of weeks.