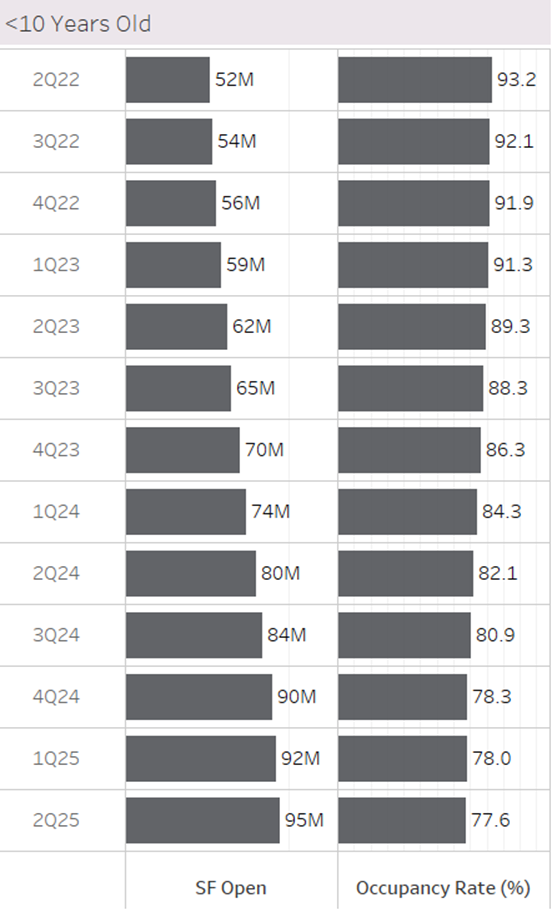

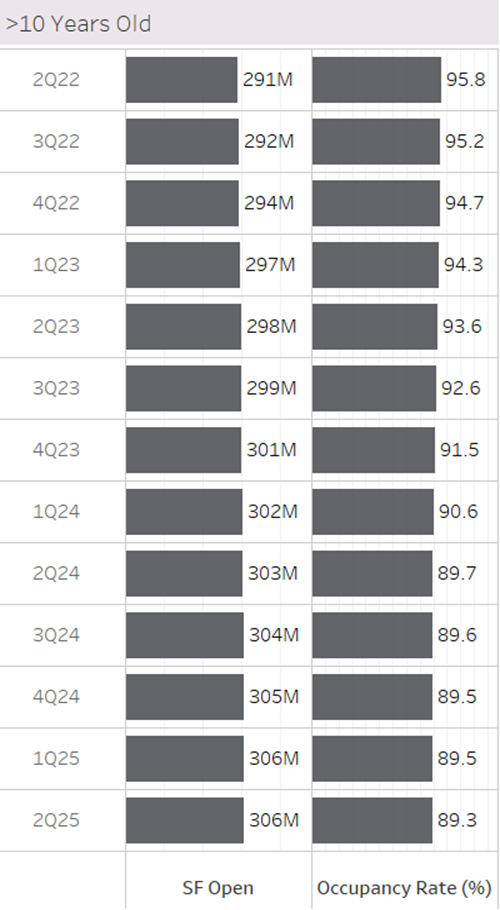

The US Life Science or Biotech real estate sector has seen tremendous growth during the past 3 years. Overall, since 2Q22, the US Life Science sector has grown by 17% to 401 million square feet (MSF) in 2Q25. But demand for space during this time has grown but not nearly as fast as underlying supply of biotech space. While research is advancing and funding is occurring, Biotech tenants have been affected by many macroeconomic factors over the past 3 years. As a result, industry wide occupancy rates have fallen from the mid 90% range in 2022 to the mid 80% range in 2Q25. Bear in mind that these rates include all life science real estate in the US including owner occupied properties and investor or 3rd party owned properties.

When we look at groups of properties that are seeing steeper losses, we can clearly see that younger properties (less than 10 years old, figure 1) have seen steeper occupancy losses compared to properties that are 10 years or older (figure 2). You can see that the properties less than 10 years old have seen their occupancy rate decline some 15.6 percentage points from 2Q22 to 77.6% in 2Q25. At the same time, LS properties 10 years old or greater have seen their occupancy fall from 95.8% to 89.3%. So, declines but to a lesser extent.

Learn more about RevistaLAB by scheduling a demo of the data service