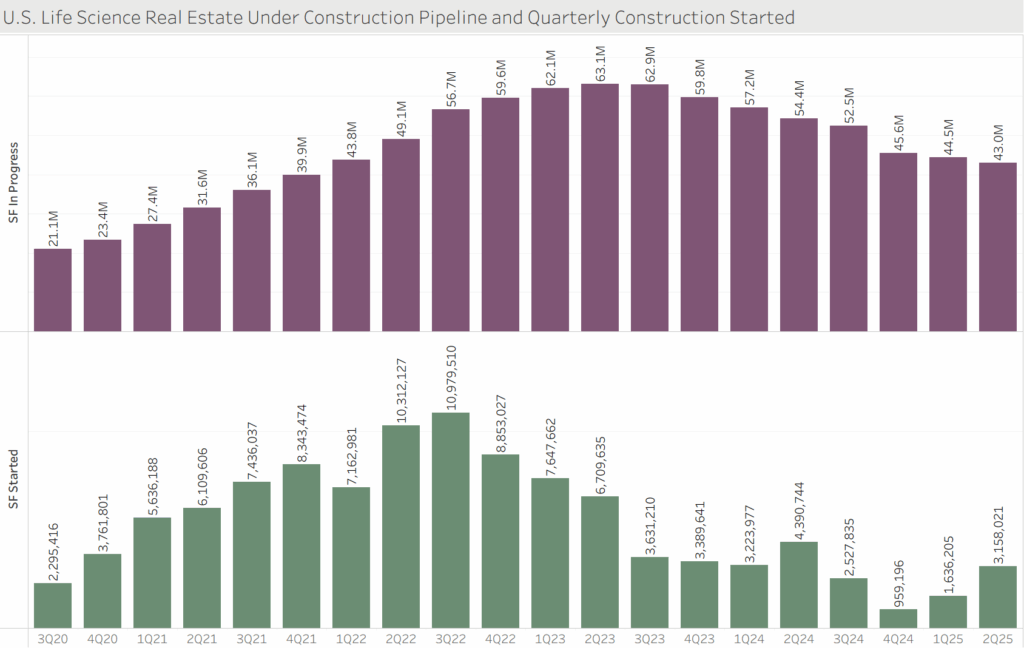

At the end of 2024, construction starts for life science projects had slowed to the lowest point since the onset of the pandemic, with less than 1 million square feet breaking ground in the fourth quarter. It appears that things may be thawing slightly, as 2Q25 saw a marked increase. While nowhere near the peak we saw in 2022, over 3 million SF broke ground across the country during the quarter. Nearly all of the projects started are 100% preleased or developed by the user, so the uptick is unlikely to add much additional pressure to fundamentals. Interestingly, none of these projects were in Boston, San Francisco, or San Diego; instead, they were concentrated in smaller, emerging markets. With the three largest clusters continuing to see the steepest occupancy declines, this may be a trend we see more of going forward.

U.S.-based manufacturing continues to be a hot topic, with a number of major pharmaceutical companies announcing substantial investments in their stateside operations. So, it probably comes as no surprise that 83% of what broke ground on a square footage basis included some form of manufacturing component. Properties with manufacturing have not experienced the same deterioration in fundamentals as their research and development-only counterparts; occupancy remains above 90% nationwide. Follow these trends and more with a subscription to RevistaLab!

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision. Use of this data is permitted subject to terms and conditions detailed on data.revistalab.com/terms-of-use and with proper credit to Revista or RevistaLab.com.

A Look at the Worcester, MA Life Science Real Estate Market

A Look at the Worcester, MA Life Science Real Estate Market