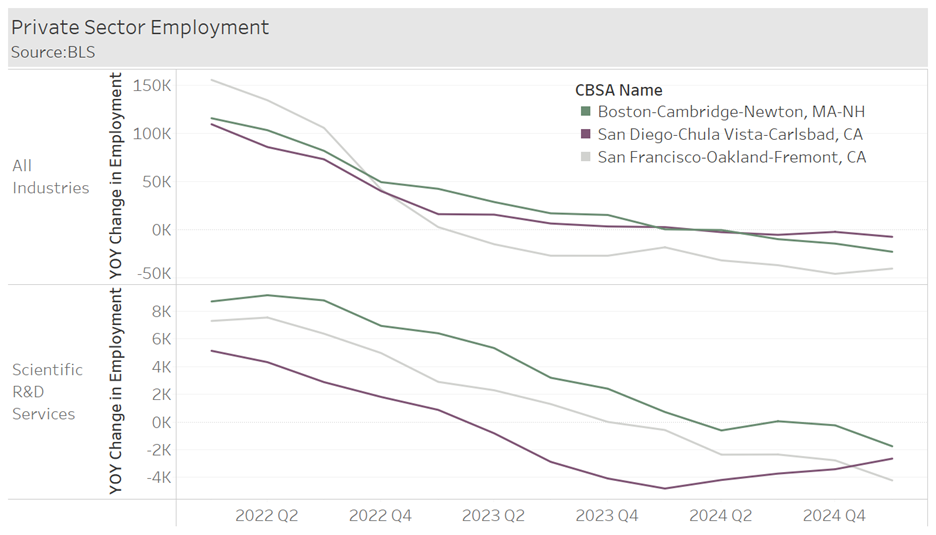

While not true of all markets, the top 3 clusters have recently faced deteriorating employment. The chart below shows the year-over-year change in employment across the private sector overall and scientific R&D individually. In 1Q2025, all three markets employed less in both categories compared to the prior year. San Francisco has struggled the most with regards to general employment. Having gone negative in 2Q2023, private employment has been decreasing for 2 years, netting a loss of 76k jobs. Boston and San Diego only started seeing decreases a year later in 2024, and the drops have been smaller.

When it comes to Scientific R&D, Boston avoided job loss the longest, but to start 2025 it is down 1.7k jobs year-over-year. This is a major headwind to life science real estate, as a trend of less employees is connected to the weak absorption we have recorded in 2025 thus far. However, it’s important to look at this next to the overarching employment, because it is clear other sectors are also feeling pressure. And if we zoom out, all three of these markets are employing significantly more R&D employees than they were 10 years ago. High growth is typically paired with high volatility, and the most recent employment data shows that as of 1Q2025, the pullback has not ended.