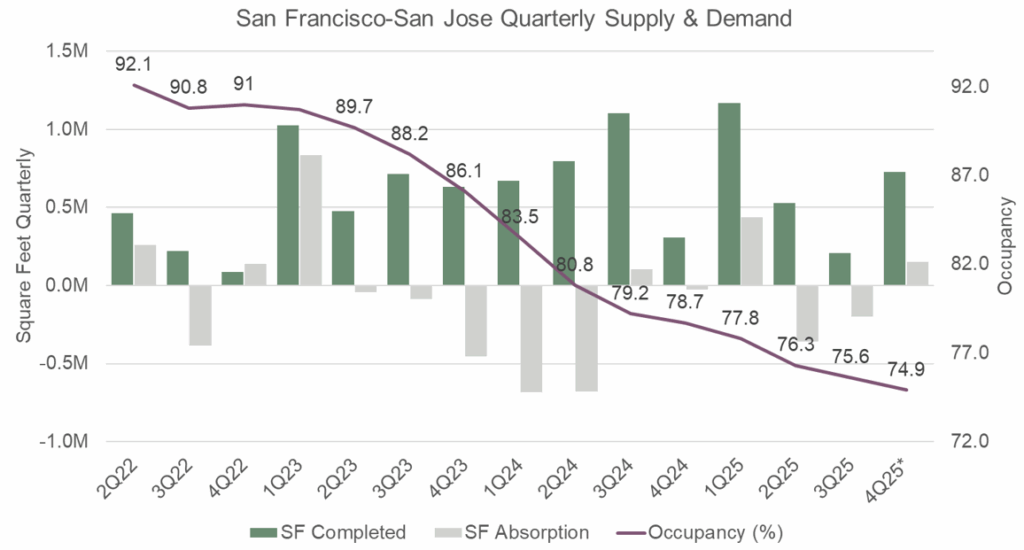

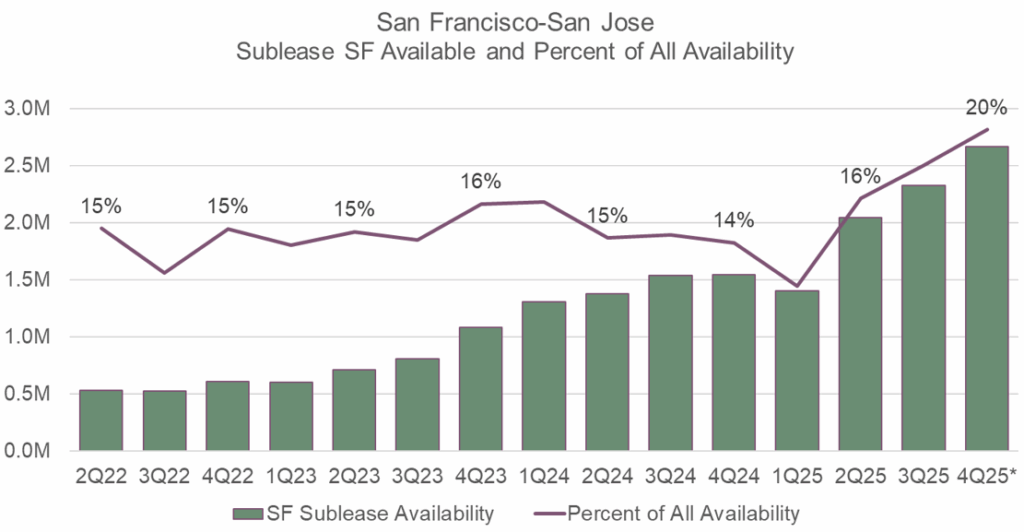

While several U.S. life science markets have begun to stabilize or show early signs of recovery, San Francisco/San Jose remains in a period of adjustment as new supply continues to deliver alongside limited demand. Market occupancy continues to deteriorate; preliminary data for Q4 shows occupancy at 74.9% for all life science properties and 69.0% for investor-owned assets only. A significant driver of this deterioration throughout 2025 has been the increase in new sublease availability. In Q1 of this year, 1.4 million square feet was available for sublease, representing 12% of total availability. Preliminary Q4 data shows this nearly doubled to 2.7 million square feet, now accounting for 20% of total available space. For comparison, San Diego’s availability is 14% sublease offerings and Boston is only 10%.

Rising sublease availability typically exerts downward pressure on rents and offers a more attractive entry point for emerging life science companies. Sublease spaces are often fully built out and available for immediate occupancy, making new construction less attractive.

Across the U.S., life science clusters are at varying stages of absorbing their speculative construction pipelines. Markets such as San Diego, Raleigh/Durham, and DC/Baltimore currently have limited exposure, with many projects fully preleased or user-driven. In San Francisco, approximately 5.8 million square feet of life science space is currently under construction, with 43% preleased. This leaves roughly 3.3 million square feet of future deliveries that may further pressure market fundamentals.

Want to see what’s available in your markets? Subscribe to Revista!

*4Q25 Data Preliminary as of 12/4