U.S. life science manufacturing has had strong tailwinds for more than five years, starting with pandemic-related supply chain disruptions and continuing with the recent policy changes that encourage onshoring. The Research Triangle and broader North Carolina market have emerged as a focal point for established pharmaceutical companies executing on this shift. Six of the largest pharmaceutical companies have committed a total of $10+ Billion to developing manufacturing facilities in the area. When these projects complete, it will likely fuel even more demand in the market, with many companies already relocating from much more expensive areas in the top 3 clusters.

Life Science inventory in the Raleigh-Durham metro area, which includes the Research Triangle, has grown by 29% in the last 3 years, from 17.5 million SF (MSF) to 22.5 MSF. This includes everything from research & development space to biotech/pharma manufacturing. Currently, less than half of the properties in the market include a manufacturing component, but that dynamic is poised to change significantly with these new developments.

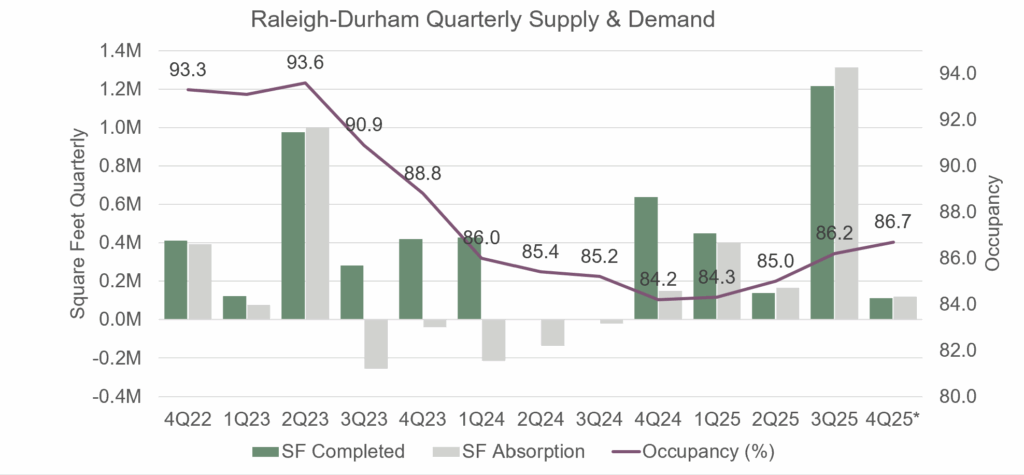

Overall, the Raleigh-Durham market has felt the same dynamics as the rest of the country in recent years, with the run-up of new speculative inventory and concurrent reduction in space demand due to a softer funding environment. It is, however, poised to rapidly recover. The construction pipeline has virtually no unsold space; projects are largely build-to-suit or user-driven. Occupancy has been beginning a rebound the last few quarters, currently sitting at 86.7% in 4Q25. Follow this market and more with a subscription to Revista!