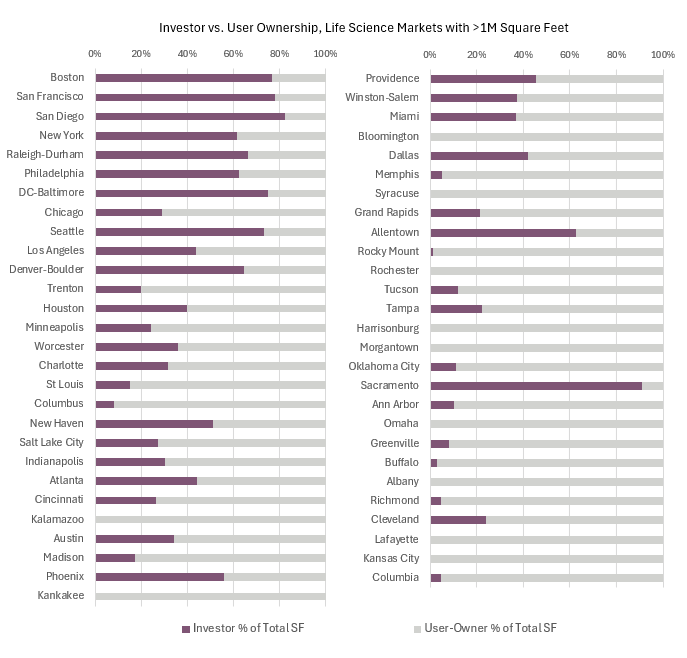

What does ownership look like in smaller life science markets? In the chart below we have simplified ownership into either investor or user-owned. The top three markets are dominated by investors, with around 80% of the square footage owned by private investors and REITs. Outside the top 3, many of the other large markets are still investor heavy, typically falling between 60-70% investor owned. Once we get out of the top 10, there is a lot more variation.

A common profile for smaller markets is a historically industrial city that now contains a manufacturing campus for pharmaceuticals, biotech, medical devices, etc. Some examples from the chart are Kalamazoo (Pfizer campus) and Syracuse (Lotte Biologics). These two markets, as well as a handful of others, are completely owned by users, so there is zero investor presence. While this is common, there are some small life science markets that have gained investor attention like New Haven, Phoenix, Allentown, and Sacramento. These four markets have more than 50% investor ownership and fall into the size category of 1-3 million square feet. Three of the four, with Sacramento being the exception, have dodged the recent occupancy troubles found in the large, investor driven markets.