With a significant amount of new inventory entering the market and weaker demand for space due to the volatile funding environment, the top three life science real estate markets—Boston, San Francisco, and San Diego—have experienced significant declines in occupancy. However, within these markets, the most established micro clusters have been relatively sheltered.

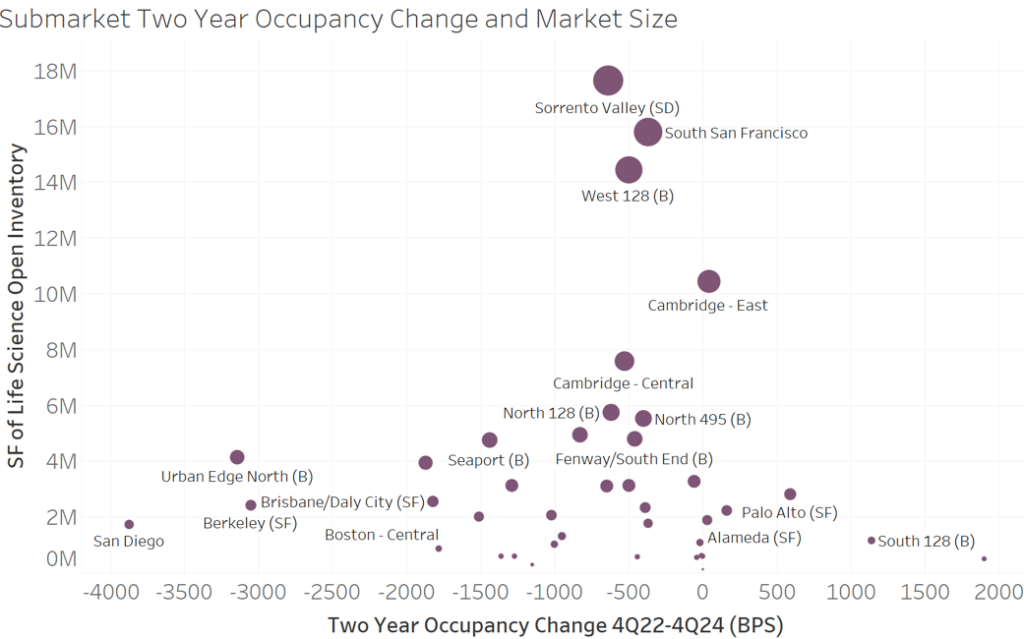

The scatter plot below illustrates each secondary submarket within these top three metropolitan areas, organizing them by size and occupancy change over the last two years. Larger submarkets are positioned toward the top, while those with greater occupancy losses are found towards the left. Notably, submarkets with a higher concentration of inventory have experienced the smallest occupancy losses. For example, Cambridge East has actually increased its occupancy by 40 basis points since 4Q22. In contrast, Urban Edge North, not too far away, has seen a decline of over 3,000 basis points in occupancy during the same time frame, dropping to 58.9% occupancy in 4Q24. Urban Edge is a much smaller submarket, and two-thirds of the inventory has opened just in the last two years. In 2024, four projects totaling 1.2 million square feet were completed fully vacant. Other markets facing similar challenges include downtown San Diego and Berkeley, CA. Stay tuned as we continue to follow these markets and more!