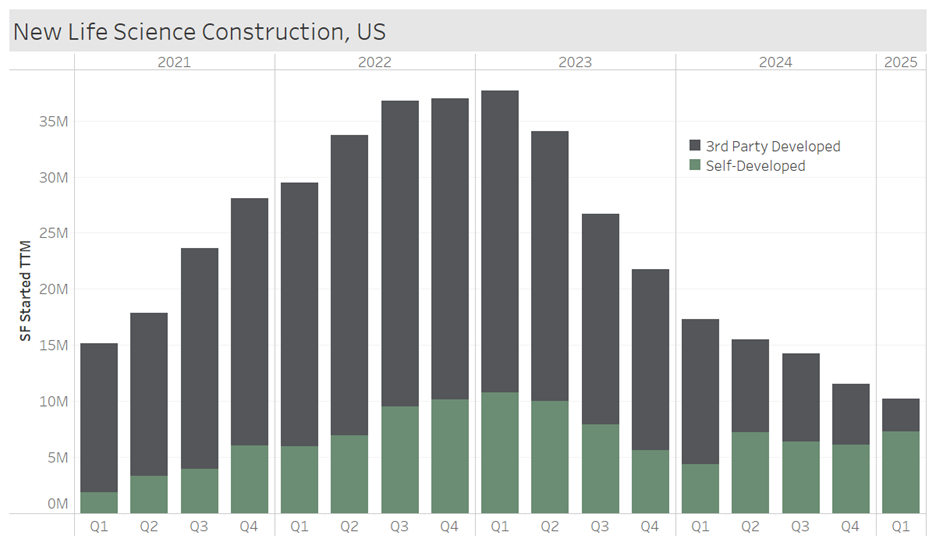

Over the past year, a little over 10 million square feet of life science projects have broken ground. While that’s only a fourth of the peak in 2022, it still seems high considering the current gap between supply and demand. To understand the types of projects still breaking ground we have broken up the trend into two categories, 3rd party developed vs. self-developed. Self-developed projects are managed by the occupier of the space. So, this is when a pharmaceutical or life science firm needs new space and decides to do the real estate development themselves. 3rd party development is either when a real estate operator develops a property to lease out, or a development firm is paid to manage the development.

The key pattern to point out is the consistency of self-developed projects compared to 3rd party. Self-developed projects are driven by an organic need for space. There is a healthy life science sector that continues to grow based on the demand for new biotechnology and therapeutics. The majority of projects that broke ground in the past year are self-developed because the science is continuing. On the opposite side we can see how much 3rd party development has fallen off, literally 1/10th of its peak. This shows that the current makeup of projects is different than it was a couple years ago, when it was primarily investor driven.