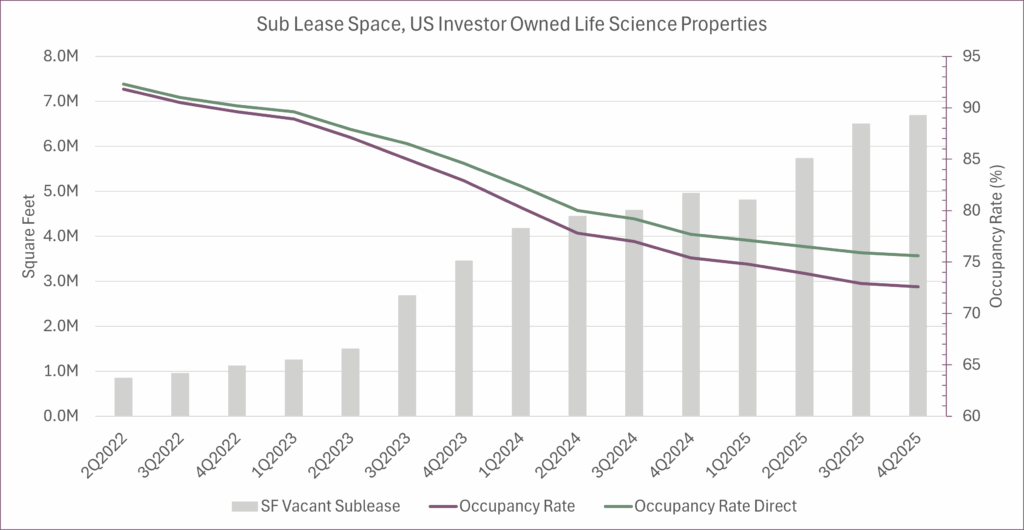

Over the past two years, there has been a trend of increasing sublease listings in the life science sector. For investor-owned life science properties, the chart below displays the square footage that is available for sublease, and the two occupancy rates that depend on whether you count sublease vacancies as real vacancy. “Occupancy Rate Direct” does not consider space available for sublease as vacant, but “Occupancy Rate” does. Operators may not think of this unused space as vacant, since it is being paid for. However, when thinking about occupancy as the intersection of supply and demand in a market, space that is empty implies a lack of demand, regardless of whether it is technically leased.

Growth in sublease availability now accounts for 3 percentage points of the overall vacancy. Several years ago, supply was tight in the hub markets, and with investments in life science exploding, many firms overestimated their future space needs. Companies secured extra space to grow into, but the subsequent supply boom left no reason to hold onto it. Sublease availability has gone from around 1 million square feet in 2022 to over 6 million 2025. This is a detail worth monitoring, as underutilized space is more likely to become vacant.