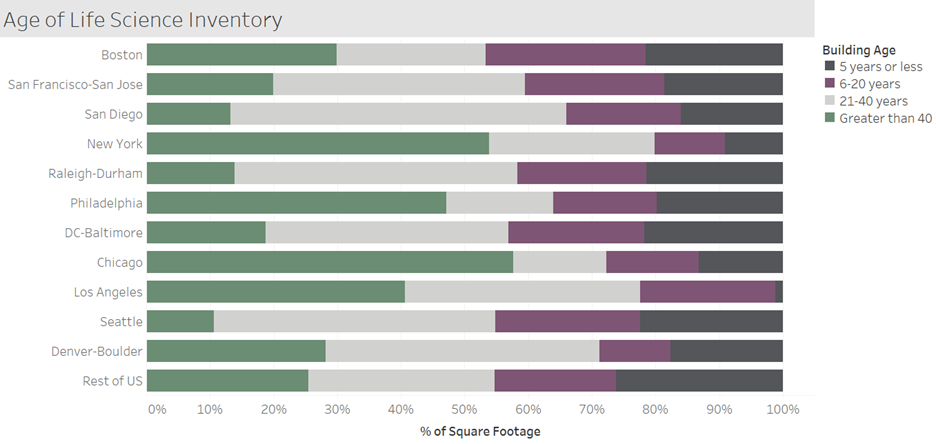

To understand each market, we have categorized life science buildings into four age groups. The markets with the most old buildings (built more than 40 years ago) are Chicago, New York and Philadelphia. This is not surprising, as these are historically industrial areas, so there are a lot of older buildings that can support industrial operations like biomanufacturing. On the opposite end, markets like San Diego, Seattle and Raleigh-Durham have a lot less life science real estate built before the 1980s.

If we look at recent construction, most markets have around 1/5 of their inventory taken up by buildings from the past 5 years. Los Angeles stands out as having significantly less new space than the other top markets. Only 1.2% of Los Angeles life science real estate was built in the past 5 years. The recent vacancy spikes are driven by the new space in overbuilt markets, which is why Los Angeles has maintained the lowest vacancy of all the clusters listed in this chart. The bulk of life science conversions come from buildings greater than 20 years old. We tend to focus our attention on the cutting edge, class A space, but its important to keep stock of the older properties.